Labour pledges to fix private renting

With the news that private renters could hold the deciding vote in 86 seats at next year's election, political parties are realising that they need to win them over.

First to make a move is Labour, whose leader, Ed Miliband, will announce plans on Thursday to introduce new laws to:

- extend the standard length of a tenancy to 3 years

- ban letting agent fees

- cap rent rises

Only a national landlord register will stop rogue landlords evading justice

A research report published by a landlord representative body today tries and fails to defend deregulation of private renting, and only reinforces the case for a national landlords register. The Residential Landlords Association has published “The impact of regulation on the private rented sector”, a report by Professor Michael Ball of Henley Business School, which claims that current regulations are failing to achieve their aims. We agree that existing regulations are not working, but what renters need is a national register of landlords.

Huge buy-to-let profit from captive tenants

A new report from Wriglesworth Consultancy and Paragon, the mortgage broker, has claimed that since the buy-to-let mortgage was launched 18 years ago, landlords have made an annual average profit of 16.3% - hugely outstripping average returns from the stock market. While this makes the UK buy-to-let market a hugely lucrative investment for landlords, it’s time to count the cost to their captive tenants.

Taxpayer cash fuels housing bubble as landlords rake in benefits

The Department for Work and Pensions (DWP) has published figures predicting that the Housing Benefit bill for private sector tenants will rise from £9.5bn in 2013/14 to £10.0bn in 2018/19 (when you take out inflation). In the same period, the number of private tenants claiming benefit will increase by more than 10%, from 1,674,000 to 1,852,000.

In the past year, house prices have risen by 9.1% and in the same period the number of buy-to-let loans has increased by 39%, as landlords spot an investment opportunity. And it doesn’t matter if they’ve paid too much because the tenant, or their housing benefit, can pay off the mortgage.

Happily renting or resigned to it?

Over the Easter weekend, the Halifax brought out the latest instalment of its Generation Rent research, which it has been conducting with NatCen. The survey of 32,000 20 to 45-year-olds found that more people no longer want to own their own home - about a quarter of those who aren't homeowners already. This number corresponds to our poll finding that two thirds of renters want to buy but cannot.

Some have ascribed the trend to young people being more content to rent for the long term, and the research finds that fewer people (though still a majority) regard renting as a barrier to settling in an area or raising a family.

But the findings are not evidence of increased satisfaction among renters; they're a collapse in confidence that they will ever own their own home. As house prices rise by double-digit inflation, home ownership is a distant dream for increasing numbers of people, and high rents make saving for a deposit more and more difficult.

The loophole that puts tenants' deposits at risk

Since 2007, tenants are supposed to have had peace of mind when handing over the best part of a month's wages at the start of a tenancy, with a government-backed deposit protection scheme. But Channel 4 News reported tonight that it's possible for a landlord to hold on to the money, then get barred from the scheme and make off with their tenants' money.

The scheme's chief exec and the chair of the National Landlords Association say the scheme works for landlords, but it quite clearly didn't work for the 160 tenants who saw their money disappear. The deposit protection scheme simply won't protect deposits until this loophole is closed. We're calling on the government to review the scheme, and for the NLA to pay back the money that isn't protected.

Channel 4's subject, Daniel Burton, rented flats from the owners only to sublet rooms to tenants, and is now running letting agents. His case serves as a reminder of the need for a register of landlords - and mandatory licensing of letting agents.

Want to improve the private rented sector? Join the Vote.

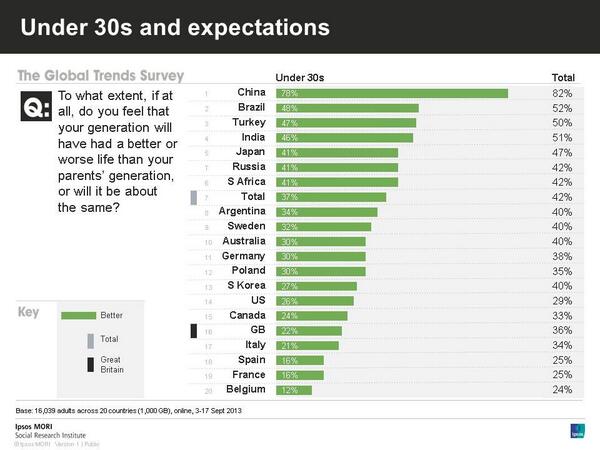

Ipsos Mori’s Global Trends Survey this week found that only 22% of under-30s in Britain think that they will have a better life than their parents' generation – a lower figure than the USA, Japan, Germany, Sweden, Australia and Canada.

House prices 10% higher for first time buyers

This morning, the Office for National Statistics revealed the latest miserable house price index. People who want to buy their first home must now pay 10.5% more than they would have a year ago - a figure that rises to 17.5% in London.

Shared ownership - affordable housing for those who don't need it?

Shared ownership is touted in some quarters as the answer to the housing crisis, but, as Harriet Meyer’s piece in yesterday’s Observer finds, existing schemes don’t seem to help anyone who needs it.

The idea is that people who can’t afford the full price of a house can buy, say, a quarter of it and rent the rest, which is typically cheaper than renting 100% and also lets them build up an asset. It was designed with “key workers” in mind – those public servants like nurses or teachers who have to spend their careers in areas that are not affordable on a modest salary.

Compulsory registration of landlords and letting agents, mandatory safety checks; what we can take from the Welsh Housing Bill.

The motion to agree the general principles of the Welsh House Bill was unanimously carried in the Welsh National Assembly this week. The Housing Bill aims to improve the supply, quality and standards of housing in Wales and takes various aspects of housing into account, ranging from tackling homelessness to legislating within the private rented sector. In a positive move for renters, the Housing Bill specifically sets out legislation for compulsory registration and licensing of all landlords and agents. Furthermore, it has been suggested that the bill include a legal requirement for landlords to undertake regular safety inspections, such as electrical inspections, in all private rented housing, so the bill may yet improve.

DCLG review of property conditions in the private rented sector: The Generation Rent response

As recent reports have shown, private renters regularly face problems with the safety and fitness of their homes. Recognising this, the Department for Communities and Local Government is currently conducting a review into property conditions in the private rented sector and policy to improve standards.

To read Generation Rent’s submission, click here.

The generation rent vote could decide the 2015 election

Private renters could hold the deciding vote in 86 parliamentary seats at next year’s General Election. That’s the big finding of analysis based on our ComRes poll that we have published today.

Heating, Eating, or Paying Rent?

Figures released by Generation Rent today add to the growing body of evidence that the private rented sector is failing tenants and needs to be reformed. Based on an opinion poll from ComRes, Generation Rent has found that the cost of rents continues to hit too many, with 39% of those polled cutting back on heating due to the cost of rent and a third reducing their spending on food. Affordability also keeps people stuck in private renting when they want to leave. Two thirds of renters say that the main reason they rent is because they cannot afford to buy their own home.

Latest figures on the PRS show why we need a national private renters’ campaign

The latest English Housing Survey was released last month, covering the period from April 2012 to March 2013, based on field surveys of a sample of 13,652 households.

The survey covers all housing tenures but has a particular resonance for private renters. As has been widely reported, the PRS is now the second largest housing tenure behind home ownership, at four million households. This amounts to 9.1 million private renters in England, calculated multiplying the number of households by average PRS renter size. Unfortunately the statistics do not paint a good picture for private renters and show why campaigning on these issues is so vital.

Spiralling housing benefit costs in the PRS mean it’s time to cut out the free market

Astonishing figures recently published by the GMB union show the huge profits that landlords in the private rented sector are making through housing benefit payments.

The numbers show how the welfare bill is directly inflated by the huge rents that landlords are charging to their tenants on housing benefit, costing the state millions each year and ending up in the pockets of a small number of people

Change renting culture…but what about the money?

Earlier this year, Ed Miliband set out proposals for Labour’s housing policy when in power. On the face of it, his plans are generally positive and certainly a step forward for renters. Writing in the Evening Standard and focusing on London, he called for a national register of landlords and the regulation of letting agents – both policies that chime with Generation Rent’s belief that these sectors need minimum standards of management and more transparency for tenants. Of course, we await the exact details of these policies, which would require enforcement powers and resources to ensure that they were effective.